«We are your strategic ally for doing business with the United States»

Our goal is to promote and encourage the increase of bilateral trade relations in the DR-CAFTA region (United States, Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica and Dominican Republic) through international trade and attracting foreign investment to the country, with the appropriate technical advice and focused on exports, imports and internationalization of companies.Services

- Matchmaking – Business Dating

- Consultancy and Training - International Trade

- Company Profile Study

- Labelling Analysis -FDA

- Trade Contacts

- Investigations

- USA Outlook Newsletter

- Strategic Alliances

Management of business appointments with potential customers/suppliers nationally or abroad.

The purpose of this service is to help entrepreneurs to do business with national and foreign companies to buy/sell products/services that are relevant to the development and expansion of their company. Since AMCHAM is one of the leading entities in Guatemala, it acts as a business facilitator, handing over the benefit to the entrepreneur.

Specialized consulting in foreign trade. We have the support of specialists with knowledge in Free Trade Agreements, regulations and market access requirements, duty information, customs, among other issues related to international trade.

Talks and events aimed to promote trade, attract investment and internationalization that drive business development and foster international trade relations.

Service created with the purpose of providing American companies with general, financial, commercial and reputable information about Guatemalan companies and vice versa.

To reduce the risk when investing or doing business with the counterparty in another country.

We offer technical analysis according to FDA regulations on food labels to be exported to the United States.

FDA consultancy for applicable sectors: Food, Cosmetics, Over The Counter Drugs (OTC), Dietary Supplements, Drugs, Medical Equipment.

- Labelling and ingredient analysis, additives, colorants.

- Food Facility Registration.

- Registration of Trademarks and others.

Creation of contacts lists with potential customers or suppliers of the product or sector of interest.

We provide general business advice and support with market studies and basic information on the different states of the United States; investment procedures, statistics, economic indicators, and more.

On a weekly basis, the Trade Center Department informs people about new and important events that have taken place in the United States, providing information on economy, trade, politics, migration, etc. Contributing to commercial standards, business competitiveness in Guatemala, investment outlook, and more.

Approach counterparts in the United States to promote internationalization and foster Guatemalan companies.

Some of our alliances:

- Export Americas: Export Americas: Advice on business plans and U.S. markets.

- Demos Global: Demos Global: Advice on FDA regulations and procedures.

- Indiana University GLOBASE Program to support micro, small and medium-sized enterprises in management matters in Guatemala

Why the United States?

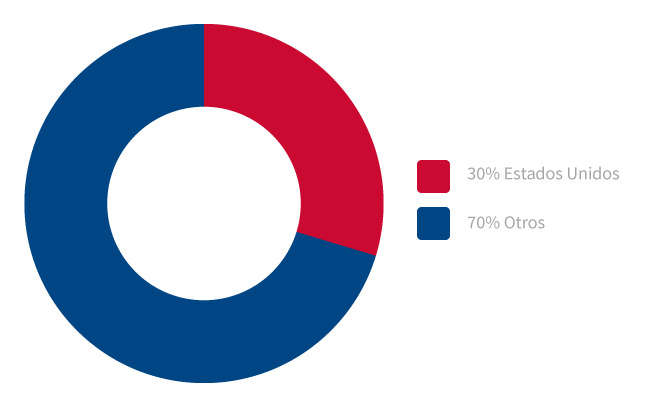

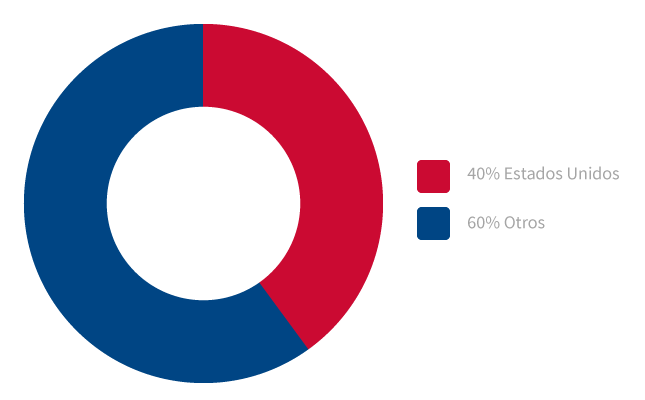

The United States is Guatemala’s first trading partner with an approximate 30% share of total exports and around 40% of imports. There are great opportunities that can be taken advantage of when entering the U.S. market and that is why AmCham encourages the internationalization of companies and product diversification.

Exports

Imports

DR-CAFTA

The DR-CAFTA (Dominican Republic-Central America Free Trade Agreement) is a bilateral agreement that seeks the creation of a free trade zone between the signatory countries. The Treaty entered into force on July 1, 2016 and represents a great trade opportunity for Guatemala, fulfilling the following objectives:- Encourage the expansion and diversification of trade in the region;

- Remove barriers to trade and facilitate the cross-border movement of goods and services;

- Promote conditions of fair competition in the free trade zone;

- Increase investment opportunities and enforce intellectual property rights.

BACKGROUND:

DR-CAFTA: Was negotiated between January 2003 and January 2004 (CAFTA), to which the Dominican Republic joined in July 2004 adapting, at that time, to the acronym DR-CAFTA.WHAT DOES DR-CAFTA MEAN?

Dominican Republic-Central America Free Trade Agreement. For its Spanish acronym: TLC= Tratado de Libre Comercio entre República Dominicana, Centroamérica y Estados Unidos.WHAT IS DR-CAFTA?

DR-CAFTA is the first free trade agreement between the United States and a group of smaller, developing economies. This agreement creates new economic opportunities by removing customs duty, opening markets, reducing barriers to trade in services, promoting transparency and establishing leading edge rules for 21st century trade by facilitating trade and investment between the parties and increasing regional integration.WHICH COUNTRIES ARE PART OF THE DR-CAFTA?

- Guatemala

- El Salvador

- Nicaragua

- Honduras

- Costa Rica

- Dominican Republic

- United States

WHEN WAS IT SIGNED?

August 5, 2004 in Washington DC, United States.ENTRY INTO FORCE OF THE TREATY:

The treaty provides, in the final provisions, that the entry into force would be on January 1st, 2005, once the United States and one or more signatory parties have notified the Depositary, in writing, that the applicable legal procedures have been completed. Otherwise it will become effective once the United States and at least one or more signatory parties give notice on the date they subsequently agree. This was the case for the current treaty, between the United States and El Salvador.- United States and El Salvador, March 1, 2006

- Honduras and Nicaragua, April 1, 2006

- Guatemala, July 1, 2006

- Dominican Republic, March 1, 2007

- Costa Rica, January 1, 2009

DR-CAFTA’S MAIN OBJECTIVES

- Regulate institutional and treaty administration matters.

- Encourage the expansion and diversification of trade in goods, services and investment between countries.

- Remove obstacles to trade and enable the cross-border movement of goods and services between the territories of the parties.

- Increase investment opportunities in the territories of the parties.

- Protect adequately and effectively, enforce intellectual property rights, employment standards and environmental regulations in the territory of each party.

- Create effective procedures for the implementation and enforcement of this treaty, for its joint administration and for the settlement of disputes.

- Establish guidelines for bilateral, regional and multilateral cooperation aimed to expand and improve the benefits of this treaty.

- Deepening Central American integration.

- Establish the legislative changes that the parties must undertake for the treaty to enter into force, in areas such as services, telecommunications and intellectual property.

TABLE OF CONTENTS

- Preface

- Chapter 1: Initial Provisions

- Chapter: General Definitions

- Chapter 3: National Treatment and Merchandise Market Access

- Chapter 4: Rules of Origin and Origin Procedures

- Chapter 5: Customs Administration and Trade Facilitation

- Chapter 6: Sanitary and Phytosanitary Measures

- Chapter 7: Technical Barriers to Trade

- Chapter 8: Trade Defense

- Chapter 9: Public Contracting

- Chapter 10: Investment

- Chapter 11: Cross Border Trade in Services

- Chapter 12: Financial Services

- Chapter 13: Telecommunications

- Chapter 14: E-Commerce

- Chapter 15: Intellectual Property Rights

- Chapter 16: Labor

- Chapter 17: Environmental

- Chapter 18: Transparency

- Chapter 19: Treaty Administration and Trade-Related Capacity Building

- Chapter 20: Dispute Resolution

- Chapter 21: Exceptions

- Chapter 22: Final Provisions

DR-CAFTA CONTENT:

It is divided into 22 chapters, each consisting of a series of articles and definitions, with its own features contained in the annexes and appendices that constitute an essential part of it. These are:Preface

The preface is formed by a series of 20 clear and precise objectives and actions that are intended to be achieved through the confirmation of DR-CAFTA. Some important highlights are:- TO STRENGTHEN the special ties of friendship and cooperation among their nations and to promote regional economic integration;

- TO CONTRIBUTE to the harmonious development and expansion of world trade and to provide a catalyst for broadening international cooperation;

- TO CREATE a larger and safer market for goods and services produced in their territories while recognizing the differences in their development levels and in the size of their economies;

- TO ESTABLISH clean and concise rules in their trade;

- TO ENCOURAGE creativity and innovation, and promote trade in goods and services that are covered by intellectual property rights;

- TO FOSTER transparency and eliminate bribery and corruption in international trade and investment;

CHAPTER ONE: INITIAL PROVISIONS

- Establishes the creation of the Free Trade Zone among the seven ratifying countries in accordance with GATT 1944 and GATS.

- It sets out the International Principles and Regulations under which the objectives of the treaty are to be governed:

- National treatment, the WTO defines it as: The Principle in which each Member treats other parties in the trade deal as they would treat their own citizens. Article III of GATT requires that imported goods be granted a treatment, no less fair than that given to identical or similar domestically produced goods after customs clearance. In Article XVII of the GATS and Article 3 of TRIPS Agreement it is also stablished the national treatment in the area of services and protection of intellectual property.[1]

- Most-favored-nation treatment; GATT 1993 defines it as: In connection with customs duties and charges of any kind imposed on or in connection with imports or exports or levied on international transfers of funds made in payment for imports or exports; in connection with the methods of levying such duties and charges, in connection with all regulations and formalities relating to imports and exports, and with regard to all matters referred to in paragraphs 2 and 4 of Article III*: any advantage, favor, privilege or immunity granted by a contracting party to a product of or for another country shall be granted immediately and unconditionally to any like product of or for the territories of all other contracting parties.[2]On the other hand, the WTO defines it as: principle of non-discrimination between trading partners.[3]

- Transparency: Level of visibility and predictability of trade policies and practices and their development process.

- Affirms the rights and obligations of the parties to the WTO Agreement and other related agreements. For the sake of certainty, it will be possible to maintain its existing legal instruments and adopt measures relating to Central American integration that do not violate the treaty.

- It defines the scope and obligations of the parties by adopting all necessary measures to ensure compliance with the provisions of the treaty.

CHAPTER TWO: GENERAL DEFINITIONS

It establishes the general and basic definitions for the understanding of the treaty, and through the chapter’s annex, country-specific definitions are included, of which you can highlight definitions such as:- Covered investment: in relation to a party, an investment, as defined in Article 10.28 (Definitions), in its territory of an investor of another existing party on the date of entry into force of this Agreement, or established, acquired or expanded after that date;

- Goods of a Party: These are domestic products as understood under GATT 1994 or other goods as the Parties may agree and includes goods from the party;

- Party: any State for which this treaty has entered into force;

- Record: the first four digits of the Harmonized System duty classification number;

- Preferential tariff treatment: the duty applicable under this Agreement to an originating good.

- Originating – means that you qualify under the rules of origin set forth in Chapter Four (Rules of Origin and Origin Procedures).

CHAPTER THREE: NATIONAL TREATMENT AND MERCHANDISE MARKET ACCESS

Its purpose is to guarantee and improve access and openness to markets for export products, through the establishment of clear rules that allow dynamic trade flows of goods. Section A: Establishes the general provisions applicable to trade of all goods of a party, relating to commitments of non-discrimination of goods by offering a National Treatment, and not a less favorable one. Section B: This section contains a section on Customs Duty[4] Elimination referring to the inability of the Parties to increase or adopt any new tariffs. In addition to the progressive elimination of customs duty on originating goods. To grant identical or more advantageous customs duty treatment to a good, as far as it fulfills the rules of origin. With their respective Consultation process to examine the possibility of speeding up the elimination of customs duty. DR-CAFTA Customs Duty Relief Categories[5] Category Description A Immediate access B Linear removal in 5 years C Linear removal in 10 years D Linear removal in 15 years E Non-linear removal in 15 years: grace period of 6 years, from year 7 to 10 the duty will be reduced by 33% in equal cuts, from year 11 to 15 it will be reduced by 67%, in year 15 the duty should be at 0% F Non-linear removal in 20 years: grace period of 10 years, plus linear removal in 10 years G Maintenance of customs duty rate at 0% H Maintenance of MFN Most Favored Nation customs duty, for which the duty is applied by the Central American Tariff System (SAC by its initial in Spanish) M Non-linear removal of 10 years: first two years, deduction of 2% per year, following 4 years, deduction of 8% per year and last 4 years, deduction of 16% per year. N Linear removal in 12 years O Non-linear removal in 15 years: grace period of 6 years, from year 7 to 11 the duty will be reduced by 40% in equal cuts, from year 12 to 15 it will be reduced by 60%, in year 15 the duty should be at 0% P Non-linear removal in 18 years: grace period of 10 years, from year 11 to 14 the duty will be reduced by 33% in equal cuts, from year 15 to 18 it will be reduced by 67%, in year 18 the duty should be at 0% Rate (A)/C Rate of customs duty 0% and out of rate of reduction according to category “C” Rate (A)/F Rate of customs duty 0% and out of rate of reduction according to category “F” Rate (A)/H Rate of customs duty 0% and out of rate SAC tariff is maintained Rate (A)/P Rate of customs duty 0% and out of rate of reduction according to category “P” *Source: Ministerio de Economía de la República de Guatemala Section C: It establishes the special regimes:- Exemption from customs duties: Establishes the parties’ commitment not to adopt or extend a new application of customs duty exemption to beneficiaries or new beneficiaries associated with a performance requirement. Not being able to hold it until 2009.

- Temporary Admission of Goods: It is the authorization of the temporary entrance free of customs duties, to some goods, regardless of their origin, for special purposes such as: professional equipment of people who carry out their commercial activity; like press equipment, cinematography, television, broadcasting, computing. Goods for exhibition or demonstration, commercial samples, goods for sports purposes. You can ask for an extension, but you can’t condition your income.

- Duty Free Importation for Commercial Samples of negligible value and printed advertising materials. Establishes duty free entry for samples of material of negligible value and of advertising independent of its origin that do not exceed one copy.

- Import and Export Restrictions: It establishes the parties’ commitment not to adopt or maintain any prohibition or restriction on imports of any good from another Party, or on the export or sale of any good for export to another Party. As export and import price requirements, import licensing.

- Import Licenses: states that no party shall maintain or adopt measures incompatible with the WTO import licensing agreement, as in the case of import licenses for products such as tobacco, alcohol and firearms, and must notify the parties of any new procedure or modification.

- Administrative burdens and formalities: the parties shall ensure that all fees and charges of any nature, other than customs duties, are limited to the approximate cost of the services rendered and do not represent indirect protection for domestic goods without becoming a barrier for protectionist purposes.

- Export taxes: the treaty states that no party may adopt or maintain taxes or levies on the export of a good to the territory of another party.

- Contains an exclusive section on agricultural matters, establishing rules for the administration and implementation of customs duties contingencies for merchandise, elimination of product subsidies, and agricultural safeguard measures, and the establishment of an Agricultural Review Commission and an Agricultural Trade Committee.

- The contingents, also called quotas or customs duty quotas, are mechanisms used in the Treaties to protect sensitive sectors of local production and give them a reasonable period to adjust to the opening. It refers to a volume or maximum quantity of a product that enjoys a preferential customs duty at the time of importation for a given period. Each Party guarantees that procedures to administer them will be carried out in a transparent manner, non-discriminatory, publicly available, timely, less burdensome to trade and reflect end-user preference.

- The parties commit themselves to the multilateral elimination of subsidies (benefits that the government grants to a company and represent unfair competition) to exports for agricultural goods in addition to preventing their reintroduction in any way.

- The Agricultural Safeguard Measures serve to prevent damage to national production by increased imports resulting from the treaty. When the level of imports exceeds the trigger level, the measure allows an increase in the customs duty applied according to the tariff reduction schedule. Example from Guatemala: chicken, milk, cheese, butter, ice cream, pork, paddy ricegrain rice, whole beans, vegetable oil, etc.

- Sugar Compensation Mechanism: this means that if the United States, in a specific year, does not allow imports of high sugar content products from one party under free trade conditions, the compensation to exporters will rise.

- Consultation on Trade in Chicken: Parties in the ninth year of entry into force of the treaty will review actions related to chicken.

- Agricultural Review Commission: a commission will be established in year 14 to review the implementation and operation of the treaty regarding trade in agricultural goods.

- Agricultural Trade Committee: composed of a representative of each of the parties in order to supervise, encourage, manage and consult on matters relating to this sector.

- Reimbursement of customs duties: consisting of the return of the duties of exports that meet the requirements of origin made in the period between January 1, 2004 to the date of entry into force of the treaty.

- Duty-free treatment for certain goods that will be accorded duty-free treatment when they are identified as hand-made fabrics and goods and traditional folkloric goods.

- Removal of existing quantitative restrictions: The United States removed the existing restrictions affecting exports from Central American countries. The products covered in the case of Guatemala are, for example: men’s and children’s shirts made of cotton and synthetic or artificial fibers, shorts and long pants made of cotton, sleepwear made of cotton and synthetic or artificial fibers, and wool suits for men and boys.

- Trade defense measures: the measure, such as an increase in the customs duty rate, may be applied when the increase in imports of textile or clothing goods is so high that it causes damage or threatens a branch of national production by meeting certain requirements.

- Customs cooperation: the authorities must cooperate in the observance and assistance of compliance with their laws and procedures that impact trade in goods, ensure the accuracy of claims of origin, and make verification visits.

- Rules of origin: It establishes that in most cases, it is allowed to import the fiber from any part of the world, to elaborate the yarn in the region, then the fabric and finally the confection. In addition, it is required that the yarn used in the making of the garment is originated in the parties.

- Most favored nation customs duty on certain goods: For goods covered by Chapters 61, 62, and 63 of the Harmonized System that have been cut and assembled in the territory of the parties, with fabric and yarn originating in their territory, the United States will apply only its MFN customs duty on the added value.

- Establishes the Committee on Trade in Goods which is formed by a delegate of each of the parties and shall meet, at the request of any of the parties, to deal with any matter relating to Chapters Three, Four (Rules of Origin), Five (Customs Administration and Trade Facilitation).

- It also contains a section of definitions for understanding the specific chapter and through annexes specific measures and lists of goods subject to and levels of activation, elimination of restrictions by country.

CHAPTER FOUR: RULES OF ORIGIN AND ORIGIN PROCEDURES

Section A: Rules of Origin:

Rules of origin are the specific provisions applied by a country to determine the origin of goods. Only original producers can benefit from customs duty preferences, their purpose is to avoid third countries benefiting from non-agreed preferences (triangulation). These are minimum processing requirements that imported materials must meet to produce originating goods, criteria, value of regional content, possibility of accumulating origin in the region that serve for the protection of raw material and final goods of the countries.[1] The origin criteria are:- A good wholly obtained or produced in the territory of one or more of the parties;

- It is produced entirely in the territory of one or more of the parties and (i) each of the non-originating materials used in the production of the good undergoes an applicable change in customs duty classification specified in Annex 4.1, or (ii) the good otherwise satisfies any applicable regional value content requirement or other requirements specified in Annex 4.1, and the good complies with the other applicable requirements of this Chapter; or

- A good wholly produced in the territory of one or more of the parties from originating materials only. Contains a list of common definitions.

- These criteria can be presented in two ways:

- A maximum percentage is set for the use of imported parts and materials.

- A minimum percentage of local added value is required in the last country where it was processed.

- Value of Non-Originating Materials (VNM) also called value reduction method;

- Value of Originating Materials (VOM) or method of increasing value;

- Net Cost Method used in automotive products.

- Consultations and Modifications: The parties may consult to ensure the proper, effective and uniform administration of the Chapter. At the request of a party, a rule of origin may be modified taking into account its feasibility and justification.

Section B: Origin Procedures

- Origin request: The preferential customs duties treatment must be requested by the importer by submitting a written or electronic declaration, or his knowledge regarding the origin of the goods, and, in case the basic documentation is incorrect, he must pay the venue fees.

- The certificate of origin does not have a pre-established format, as long as it is written or electronic. The Ministry of Economy defines the Certificate of Origin as the document by means of which it is declared before the authority of the importing country that the merchandise is originating from, with the purpose of being able to enjoy customs duty preferences or free trade. In this regard, the Guatemalan Chamber of Commerce defines the Certificate of Origin as: the document by which it is declared that a particular good destined for export is obtained, produced, manufactured or processed in a specific country, i.e. the country of origin[2], [3], [4]and must include: the name of the certifying person, the customs duty classification, the description and information guaranteeing the origin of the goods and, if it is a general certification, it must specify the period covered by it.

CHAPTER FIVE: CUSTOMS ADMINISTRATION AND TRADE FACILITATION

- Establishes mechanisms for the strengthening, transparency, streamlining, modernization and automation of Customs Administration and customs.

- It establishes the cooperation that the parties must have for the facilitation of trade through an agreement of mutual assistance between the customs authorities.

- Implementation of review and appeal mechanisms concerning decisions in customs matters and civil, administrative and criminal penalties for violations of customs legislation and regulations.

- Able to issue advance resolutions through a duly authorized representative regarding customs duty classification, valuation criteria, etc.

CHAPTER SIX: SANITARY AND PHYTOSANITARY MEASURES

- It contains sanitary and phytosanitary measures with the goal of protecting the life and health of people, animals and plants in the territory of the parties through the implementation of the Agreement on Sanitary and Phytosanitary Measures between the parties, providing a forum in which sanitary and phytosanitary issues are discussed, trade issues are resolved and trade opportunities are expanded.

- To establish the Committee on Sanitary and Phytosanitary Matters to seek the encouragement and communication of present and future relations between the agencies and Ministries of the parties with responsibility for sanitary and phytosanitary matters. Respond to enquiries on this subject and trade facilitation, cooperation between the arts.

- The annexes contain the list of members representing the committee by country.

CHAPTER SEVEN: TECHNICAL BARRIERS TO TRADE

- It sets out mechanisms for better implementation of the Technical Barriers to Trade (TBT) Convention, which aims to increase and facilitate trade, through the removal of unnecessary technical barriers, to trade and the promotion of bilateral cooperation.

- Establishment of voluntary agreements to accept conformity assessments.

- For the development of standards, regulations and conformity assessment procedures, each party will allow the others to join in the processes.

- The creation of the Committee on Technical Barriers to Trade, responsible for monitoring the implementation and administration of all TTO-related issues.

- It includes definitions for understanding the chapter itself.

- The annex of the chapter is aimed at the integration of country coordination.

Chapter eight: Trade Defense

Section A: Safeguards

Safeguard: is a measure arising from the reduction or elimination of a customs duty, a good originating in the territory of a party in large quantities and causing threat or serious injury or a threat thereof, applicable only during the transition period (10 years from the entry into force of the treaty as these are):- To halt the relief process established in the Treaty for that commodity.

- (b) Increase the custom duty for the good to a level not exceeding the lesser of the lowest duty charged to any country to which no duty preferences exist at the time the measure is taken; or the duty applied to the country involved, on the day immediately preceding the entry into force of the Treaty.

- Compensation: Compensation: the country party, applying a safeguard measure, must provide the other party or parties with mutually agreed compensation. This trade liberalization compensation must be a grant that has substantially equivalent effects on trade or is equivalent to the value of the additional taxes expected as a result of the measure. This country party applying the measure shall provide an opportunity for consultations within thirty (30) days of the application of the safeguard measure.

- This section confirms WTO rights and obligations. Each country party retains its rights and obligations under the WTO Agreement concerning the application of anti-dumping and countervailing duties.

- The annexes set out country-specific definitions of the competent investigating authorities for each one. [1] The Ministry of Economy defines the Rules of Origin as: These are the regulations that exist in International Trade Agreements which indicate the raw material and the minimum processes that must be considered in order to benefit from customs duty preferences. The establishment of these rules avoids triangulation, i.e. goods from countries that are not party to a trade agreement, take advantage of customs duty benefits.

Chapter Nine: Public Contracting

- Establishes any measure, act or guideline of a party, concerning the contracting coverage of services and/or services, rules of contracting procedures, terms, amounts, requirements, principles.

- Contains a list of definitions applicable to the chapter.

Chapter Ten: Investment

- It regulates investment, the measures adopted by a Party relating to investors, and investors of another Party. In cases of incompatibilities between chapter 10 and another chapter, the other chapter concerning incompatibility will prevail.

- Moreover, it provides that treatment shall be national or most-favored-nation treatment consistent with customary international law, fair and equitable treatment, full protection and security, and non-discriminatory treatment.

- It also states that no one shall expropriate or nationalize a covered investment, except for a public or any other purpose.

- This states that transfers shall be allowed to be made freely and without delay.

- Contains the resolution of disputes between Investors-State trying to solve in the first instance through consultations and negotiations, conciliation and mediation. In case it is not possible to reach an agreement, the claim must be submitted to arbitration.

- It also has a list of definitions for the chapter’s understanding and a series of application annexes for each country.

Chapter Eleven: Cross Border Trade in Services

- Provides measures adopted or maintained by a party affecting cross-border trade in services by a service supplier of another party. Not applying to services provided under governmental authority.

- Furthermore, it establishes that each party will grant the other party the National Treatment, Most Favored Nation Treatment, also granting access to markets by establishing that neither party will adopt or maintain the base of a regional subdivision that imposes limitations on the number of suppliers among others. Local presence may also be required as a condition for the cross-border provision of one or more services.

- It also has a list of definitions for the chapter’s understanding and a series of application annexes for each country.

Chapter Twelve: Financial Services:

- This chapter sets out the measures, regulations and provisions relating to financial institutions, investors elsewhere and cross-border trade in financial services intended to establish a clear regulatory framework, aimed at unifying and agreeing on regulatory environments of the parties applying the principles of National Treatment, Most Favored Nation Treatment, and market access.

- It also provides that no party may restrict the number of financial institutions, the total value of financial services assets or transactions, the total number of operations and natural persons they may employ, and specific types of legal persons or joint ventures.

- As far as cross-border trade is concerned, it provides that each party shall allow on terms and conditions to grant national treatment and service suppliers of another party to supply specific services. As well as allowing new Financial Partners without additional legislative action by the party. Moreover, it does not require another party to disclose information relating to financial business and individual customer accounts.

Chapter Thirteen: Telecommunications

- Establishes measures adopted or maintained by a party relating to access to and use of public telecommunications services; measures adopted or maintained by a party relating to obligations of suppliers of public telecommunications services; other measures relating to public telecommunications networks or services; and measures adopted or maintained by a party relating to the supply of information services.

- Also, it is guaranteed that the companies of the other party have access to, and can make use of, any public telecommunications service offered in their territory or on a cross-border basis.

- Moreover, it establishes the guarantee that the providers of public telecommunications services in its territory provide interconnection to public service providers, as well as the resale of those services and the guarantee of the portability of a number, in addition to parity on the dial without unreasonable delays.

- It requires that there should be treatment no less favorable than the treatment of major suppliers, and the maintenance of each part of Safeguard measures.

- It regulates matters relating to the settlement of disputes, guaranteeing the right to appeal to the Telecommunications Regulatory Body for dispute resolution.

- It also guarantees mechanisms of transparency and flexibility in the selection of technologies.

Chapter Fourteen: E-Commerce

- Recognizes the importance of economic growth and the opportunity that e-commerce creates, the importance of avoiding obstacles to its use and development, and the applicability of WTO rules. It also prevents a party from levying internal taxes, directly or indirectly on digital products, if they are inconsistently levied. Also not impose customs duties, fees or other charges related to the importation of digital products by electronic transmission.

- To ensure transparency, e-commerce regulations should be publicly available.

- The Parties are also committed to cooperate on the importance of e-commerce, work together to overcome obstacles, share information and experiences on laws, regulations and programs in the field of e-commerce.

Chapter Fifteen: Intellectual Property Rights

- Establishes that each party may apply relative protections for the enforcement of intellectual property rights, Trademarks, Patents and procedures in its national legislation.

- Commitment to gradually ratify the WIPO Copyright Treaties, WIPO Performances Treaty and Phonograms; Patent Cooperation Treaty, Budapest Treaty on the International Recognition of the Deposit of Microorganisms for the purposes of patent procedure. Agreement on the Convention Relating to the Distribution of Program-Carrying Signals Transmitted by Satellite and the Trademark Law Treaty.

- Furthermore, the parties assert their existing rights and obligations under the ADIC agreement and intellectual property agreements concluded or administered under the WIPO support.

- It states that the parties must have an electronic system for the application, processing, registration and maintenance of trademarks, as well as a publicly available electronic database.

- The gears shall ensure that the subsequent initial registration and renewal of it shall be for a term of not less than ten years.

- Each party shall state that authors, performers and producers of phonograms shall have the right to authorize and prohibit any reproduction of their work, performances, temporarily or permanently, including storage, in addition to making the original or copies of their work establishing terms available to the public.. In case of a natural person, the term shall not be less than the life of the author more than 70 years from his death and on a basis other than the life of a natural person the term shall not be less than 70 years.

Chapter Sixteen: Labor

- The parties affirm their obligations and commitments as members of the ILO. Each party shall endeavor to ensure that international labor principles and labor rights are recognized and protected by its laws. As well as full respect for their Constitutions. In addition, each party must guarantee access to courts and due process, fair, equitable and transparent, public hearings, the right to a defense, a speedy process and not too onerous.

- Creation of a Labor Affairs Council consisting in representatives of ministerial levels or their equivalent or whoever is appointed to oversee the implementation and review the progress of this chapter and including the activities of the established Labor Cooperation and Capacity Building Mechanism.

Chapter Seventeen: Environmental

- It requires that each party has the right to establish its own levels of environmental protection and its environmental development policies and priorities, to adopt or modify its laws and policies that provide high levels of environmental protection. Also, each party should strive to improve those laws and policies.

- It stipulates the establishment of an Environmental Affairs Council to oversee the implementation and review of progress in accordance with the Environmental Cooperation Agreement between the United States of America and Central America and the Dominican Republic.

- The parties recognize the importance of cooperation in protecting the environment, promoting sustainable development and strengthening trade and investment relations.

Chapter Eighteen: Transparency

- It establishes the duty to set up a liaison point to facilitate communications between the parties on any matter concerning transparency.

- In the interests of transparency, parties should make public laws, regulations, procedures and administrative rulings of general application.

- Each party shall establish or maintain judicial procedures for the prompt review or correction of final administrative actions involving transparency issues, and impartial challenge mechanisms providing for prompt review must be ensured.

- The parties state their resolution to eliminate bribery and corruption in international trade and investment by adopting anti-corruption measures, such as the enactment of legislation, [this sentence is incomplete]

Chapter Nineteen: Treaty Administration and Trade-Related Capacity Building

- The Free Trade Commission is created for the purpose of establishing rules of dispute settlement procedures related to the interpretation or application of the treaty, monitoring the execution and further development of the treaty, and supervising the work of committees and working groups.

- It will be formed by a coordinator designated by each party, who will work together in the development of agendas as well as other preparations and follow-up of decisions of the commission.

- It also establishes the trading related Capacities Committee which aims to provide assistance for trade-related capacity building, which is a catalyst for the reforms and investment needed to foster trade-led economic growth, poverty reduction and free trade adjustment, with the following objectives:

- Search for prioritization of trade-related capacity building projects at national or regional level, or both.

- Invite international and national institutions to assist in the development and implementation of projects.

Chapter Twenty: Dispute Resolution

- It states that all parties shall always cooperate and seek agreement on the interpretation and application of the treaty.

- It regulates that the contingencies arising will be resolved before a forum chosen by the complaining party.

- Points out that any of the parties may request, in writing to any other party, the undertaking of consultations in case of any existing or project measure.

- It provides that neither party may grant a right of action in its law against any party on the ground that the other party has breached its obligations.

- It also establishes the encouragement and facilitation of arbitration for the settlement of international commercial disputes between private parties in the free trade zone.

Chapter Twenty-One: Exceptions

- It establishes the outstanding cases by which the parties may separate from their commitments in General Cases, Essential Security Cases, Taxation, Balance of Payments Measures to Trade in Goods, and Disclosure of Information, in addition to providing a list of definitions for the understanding of this chapter.

Chapter Twenty-two: Final Provisions

- It states that the annexes, appendices and footnotes constitute an integral part of the treaty.

- Establece el procedimiento en caso de alguna Enmienda y que estas formaran parte integral del tratado.

- It establishes the procedure in case of an Amendment and that this should form an integral part of the treaty.

- It specifies that no party may undertake reservations to the treaty without the consent of the parties.

- Establishes the date and manner of entry into force of the treaty.

- Any country or group of countries can join the treaty.

- It sets the procedure of Denunciation of the treaty, which is notifying the withdrawal to the depositary who will inform the other Parties without delay.

For more information on how we can support you in doing business with the United States and the region, please contact: Carolina Barrientos Phone: 2417-0805 cbarrientos@amchamguatemala.com